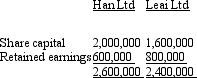

Jabba Ltd acquired a 70 per cent interest in Han Ltd on 30 June 2012 for $2,000,000.On the same date,Han Ltd acquired a 60 per cent interest in Leia Ltd for a cash consideration of $1,600,000.The purchase price represents the fair value of consideration transferred for both investments The share capital and retained earnings at the date of acquisition are as follows: What is the non-controlling interest in Han Ltd and Leai Ltd,respectively on the date of acquisition using the partial goodwill method (round to the nearest dollar) ?

What is the non-controlling interest in Han Ltd and Leai Ltd,respectively on the date of acquisition using the partial goodwill method (round to the nearest dollar) ?

Definitions:

Real Interest Rate

The inflation-adjusted interest rate, representing the actual borrowing cost and the genuine earnings for savers.

Real Value

The worth of a good or service adjusted for inflation, showing its true purchasing power.

Output

The amount of goods or services produced by a company, country, or economic system within a certain period.

Inflation Tax

An implicit tax that results from the erosion of purchasing power due to inflation, effectively reducing the real value of money held by the public.

Q9: Which of the following statements are incorrect?<br>A)

Q17: Sunny Ltd,Rain Ltd and Cloud Ltd contractually

Q21: Jackson Company had a net increase in

Q21: The NSW Environmental Protection Authority's report,Corporate Environmental

Q31: If a venturer contributes assets to a

Q35: Santa Fe Company was started on January

Q37: AASB 131 "Interests in Joint Ventures" prescribes

Q47: Payments to insurance contracts that relate to

Q55: Which reporting approaches have been adopted in

Q56: Requirements regarding after-reporting-date-events are contained in AASB