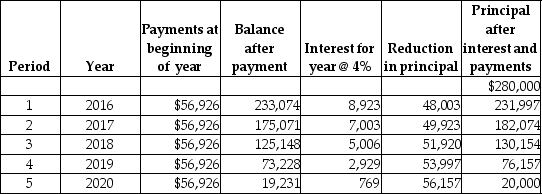

The following amortization schedule is for a lease entered into at the start of fiscal 2016 for an asset that will be useful for 5 years.The company uses straight-line depreciation method.

Required:

Required:

Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31,2017,distinguishing amounts that are current from those that are non-current.

Definitions:

Earnings Per Share

A financial metric that indicates the portion of a company's profit allocated to each outstanding share of common stock.

Cash Dividends

Distributions of a company's earnings to its shareholders in the form of cash.

Federal Income Tax

A tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Double Taxation

The imposition of two or more taxes on the same income, asset, or financial transaction.

Q7: With futures contracts, the price at which

Q9: Jaime wrote a nine-month put on Beta

Q14: A company has a defined benefit pension

Q30: For the following lease,under IFRS,determine the minimum

Q31: For the year ended December 31,2016,Harvest Productions

Q37: For the following lease,determine the minimum present

Q77: All futures contracts are traded on a

Q83: What is the accepted method of accounting

Q85: What is meant by the agency cost

Q108: Withering Inc.began operations in 2015.Due to the