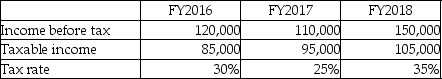

What is the deferred tax liability under the deferral method for FY2018?

Definitions:

Fixed Manufacturing Overhead Cost

Overhead costs related to manufacturing that remain constant regardless of the level of production, such as factory rent and salaries of supervisors.

Variable Manufacturing Overhead

Costs in manufacturing that change with the level of production output, like utilities or raw materials.

Direct Labor-Hours

The total hours worked by employees who are directly involved in the production of goods or services.

Predetermined Overhead Rate

A predetermined overhead rate is an estimated charge per unit of activity that is used to allocate indirect costs to products or services.

Q8: Assume an investor thinks the stock market

Q21: One reason that commodities appeal to investors

Q24: Explain why accounting does not recognize gains

Q44: Below are details relating to balances for

Q57: Select transactions of SimBis Accounting Inc.(SAI)are listed

Q75: Use the following information to calculate the

Q75: Which of the following characteristics apply to

Q87: The following are some of the characteristics

Q88: In the first year of operations,a company

Q98: What are the similarities and differences between