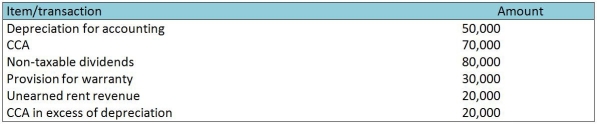

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet.Treat each item independently of the others.Assume a tax rate of 30%.

Definitions:

Poison

A substance that, if taken internally or applied externally, is a threat to life.

Hypoglycemia

A condition characterized by an abnormally low level of glucose (sugar) in the blood, often leading to symptoms such as shakiness, sweating, and confusion.

Hyperglycemia

A condition characterized by an abnormally high level of glucose in the blood.

Heat Exhaustion

A condition resulting from exposure to high temperatures, characterized by dehydration, heavy sweating, and fatigue, often progressing to heat stroke if not treated.

Q5: Describe the options available for reporting held-for-trading

Q7: What amount is included in the pension

Q10: What is the income tax payable under

Q18: Based on the characteristics provided below,what kind

Q38: Stretton Company Limited,a private company,was started on

Q46: Which of the following statements is correct?<br>A)

Q62: Arlington Corp issued $7,000,000,5% 6-year bonds on

Q75: What is hedging?

Q102: The following amortization schedule is for a

Q104: Assume that MAK agrees to purchase US$500,000