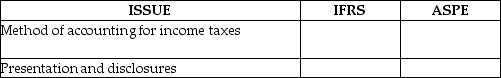

Using the following table,contrast the substantive differences between IFRS and ASPE for (a)the method of accounting for income taxes and (b)presentation and disclosure.

Definitions:

Storage Cost

Represents the expenses involved in storing inventory or materials, including warehousing, labor, and material handling costs.

Ordering Cost

The expenses associated with placing an order for additional inventory, including administrative costs and the cost of obtaining goods.

Purchase Price

The amount of money paid to buy a good or service.

Safety Stock

Additional inventory held to protect against uncertainties in demand or supply, ensuring sufficient stock is available to meet customer needs.

Q10: For the following transaction,provide all of the

Q26: A company had taxable income of $2

Q30: For the following lease,under IFRS,determine the minimum

Q46: Why are banks able to pay such

Q51: Katie Ltd.'s policy is to report all

Q56: Why is the taxes payable method not

Q65: Which statement is correct?<br>A) Contingencies arise from

Q82: Identify if the following investments meet the

Q108: Withering Inc.began operations in 2015.Due to the

Q118: When will there be a recapture of