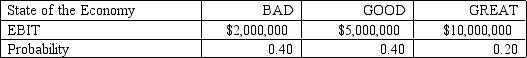

ABC Corporation has a capital structure that consists of $20 million in debt and $40 million in equity. The debt has a coupon rate of 10%, while the industry return on equity is 15%. ABC Corporation is unsure of the state of the economy in the next year. The tax rate facing the company is 40%.

-Refer to ABC Corporation.The company is considering the issue of $10 million in new debt at a rate of 10%.The funds from the new debt will be used to retire $10 million in equity.Currently,there are 1 million shares outstanding trading at $40 per share.Assuming the stock price will remain the same,what is the expected earnings per share in the next year if the company goes through with the re-capitalization?

Definitions:

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits one could have received by taking a different action.

Household Production

Economic activities and tasks performed within the home, such as cooking and cleaning, contributing to the family's welfare but not counted in formal GDP.

Sunk Cost

Expenses already paid that cannot be retrieved and should not affect upcoming business choices.

Specialized Resources

Resources that are particularly suited or adapted for specific tasks or industries, leading to efficiencies in production and increased economic output.

Q3: At what inventory level of this input

Q7: The multiyear action plan for the major

Q13: Consider a project with the following cash

Q15: What is Bavarian Sausage's breakeven point in

Q36: Firm Y issued $100,000,000 of bonds last

Q64: You are about to embark on a

Q69: Consider the following information for Smart Products:

Q84: What is Bavarian Brew's bad debt expense

Q87: A firm's weighted average cost of capital

Q92: Refer to DSSS Corporation.What is the depreciation