Normaltown Corporation

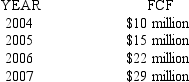

An analyst has predicted the free cash flows for Normaltown Corporation for the next four years:

-After 2007,the free cash flows are expected to grow at an annual rate of 5%.If the weighted average cost of capital is 12% for Normaltown,find the enterprise value of the firm.

Definitions:

Body Language

Non-verbal communication through physical behaviors, such as facial expressions, gestures, posture, and eye movement, which convey messages or emotions.

Wealth And Power

The significant influence and control over resources and decision-making processes that individuals or groups may possess due to their economic status.

Organizational Position

The rank or status that an individual holds within a company's hierarchy.

Aggressive

Characterized by or displaying assertive, bold, and sometimes forceful behavior or attitudes.

Q2: What is the proper goal for management

Q6: Unsecured bonds that have legal claims inferior

Q22: You are planning your retirement and you

Q39: The first public sale of company stock

Q58: You want to buy a new car.The

Q66: A firm plans on paying a constant

Q69: EmmaCat Industries estimates that the scratching post

Q79: Refer to Gamma Electronics.What's the payback period

Q102: Roxy Incorporated expects non-normal dividend growth over

Q111: Which of the following cannot be calculated?<br>A)