Normaltown Corporation

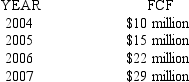

An analyst has predicted the free cash flows for Normaltown Corporation for the next four years:

-After 2007,the free cash flows are expected to grow at an annual rate of 5%.If the weighted average cost of capital is 12% for Normaltown,find the enterprise value of the firm.

Definitions:

Distinctive Quality

A unique characteristic or feature that sets an individual, item, or entity apart from others.

Registered Mark

A trademark that has been officially registered with a recognized government authority.

Trade Secrets

Intellectual property that consists of confidential business information which provides a competitive edge.

Computer

An electronic device capable of executing a series of arithmetic or logical operations to process data, often programmable.

Q14: Refer to NPV Profile.What's the IRR for

Q20: _ represents the amount of cash that

Q29: Emma Bonds have 12 years to maturity,with

Q35: Suppose you are interested in the following

Q41: The preferred technique for evaluating most capital

Q55: The beta of the risk-free asset is:<br>A)

Q73: A firm has a capital structure of

Q82: Since the Tax Relief Act of 2003,if

Q92: A few years after graduating from college,you

Q95: Fence Place Diary Company (FPD)has a 15-year