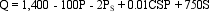

Demand Curve Analysis. Papa's Pizza, Ltd., provides delivery and carryout service to the city of South Bend, Indiana. An analysis of the daily demand for pizzas has revealed the following demand relation:

where Q is the quantity measured by the number of pizzas per day, P is the price ($), PS is a price index for soda pop (1992 = 100), CSP is the college student population and S, a binary or dummy variable, equals 1 on Friday, Saturday and Sunday, zero otherwise.

A. Determine the demand curve facing Papa's Pizza on Tuesdays if P = $10, PS = 125, and CSP = 35,000, and S = 0.

B. Calculate the quantity demanded and total revenues on Fridays if all price-related variables are as specified above.

Definitions:

Use Of Assets

This involves the effective and efficient employment of a company's resources to maximize profitability and productivity.

Profit Margin

A financial performance metric that shows the percentage of revenue that exceeds the cost of goods sold, indicating the efficiency of a company in generating profits.

Operating Income

The profit realized from a business's core operations, calculated by subtracting operating expenses from gross profit.

Profit Margin

A financial metric indicating the percentage of revenue that remains as profit after deducting expenses.

Q12: Goods for which e<sub>I</sub> > 1 are

Q18: An isoquant represents:<br>A) input combinations that can

Q19: Incremental Costs. Infinite Audio, Inc., manufactures car

Q22: Social marginal cost is the cost borne

Q30: Which finance career classification involves analyzing a

Q36: If the production of two goods is

Q37: If total revenue increases at a constant

Q42: Government seeks to aid economic efficiency in

Q49: Degree of Operating Leverage. Heat Tamers, Inc.,

Q75: A stock purschased on the New York