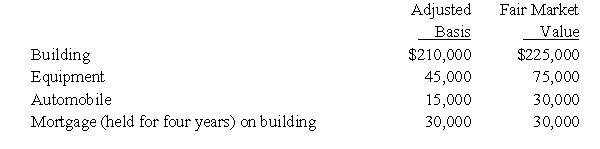

Rick transferred the following assets and liabilities to Warbler Corporation.

In return Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

Definitions:

Depreciation

A method of allocating the cost of a tangible asset over its useful life.

Comparative Income Statement

A financial statement that compares income, expenses, and net income over different periods, helping to identify trends and assess performance.

Variable Cost

A cost that varies with the level of output or activity, such as raw materials, labor, and utility expenses.

Q5: Price/Output Determination. Sun City, Arizona, a retirement

Q7: Long-run Firm Supply. The Los Angeles retail

Q8: In a § 351 transfer,a shareholder who

Q23: A technical advice memorandum is issued by:<br>A)Treasury

Q29: On January 2,2008,Green Corporation purchased equipment with

Q36: ParentCo purchased all of SubCo's stock on

Q39: Percentage Tax and Inelastic Demand. Assume the

Q45: Chev Corporation,a calendar year corporation,has alternative minimum

Q64: Max is the sole shareholder of Smart

Q78: LargeCo files on a consolidated basis with