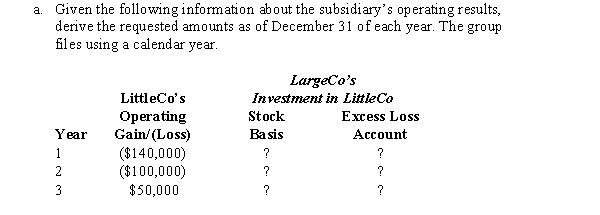

LargeCo files on a consolidated basis with LittleCo.The subsidiary was acquired for $250,000 on January 1,year 1,and it paid a $40,000 dividend to LargeCo at the end of both year 2 and year 3.

b.LargeCo sold LittleCo to an unrelated competitor for $400,000 on December 31, Year 3. How will LargeCo account for this sale?

Definitions:

Referent Power

Influence based on being admired or respected, allowing individuals to persuade others because of their personality, integrity, or other attractive traits.

Coercive Power

The ability to influence others' behavior by threats, punishment, or negative reinforcement.

Reward Power

The ability of an individual to influence others' actions by controlling the allocation of rewards.

Compliance

The behavior of targets of influence who agree to readily carry out the requests of the leader.

Q6: Of the § 179 expense deducted in

Q12: Tara incorporates her sole proprietorship,transferring it to

Q25: Section 721 provides that no gain or

Q33: A country with very low or no

Q41: Method for assigning deductions to correct source.

Q55: Limits nonrecognition treatment to reorganizations that are

Q60: Which of the following statements regarding ownership

Q89: Both the corporation and its shareholders may

Q102: As of January 1 of the current

Q130: ParentCo purchased all of the stock of