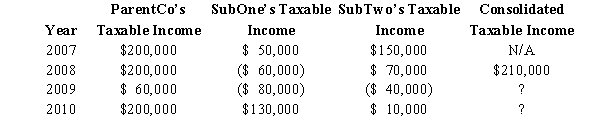

ParentCo,SubOne and SubTwo have filed consolidated returns since 2008.All of the entities were incorporated in 2007.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

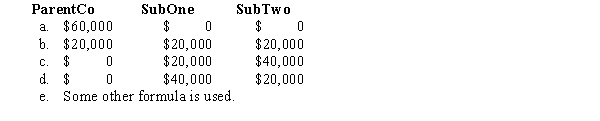

How should the 2009 consolidated net operating loss be apportioned among the group members?

Definitions:

Pleasure and Desire

Fundamental aspects of human psychology that drive behaviors, with pleasure being a state of gratification and desire the longing for certain experiences.

Avoidant

A term often related to behavior or personality, indicating a tendency to withdraw from or avoid certain situations or interpersonal connections.

Passive

Accepting or allowing what happens or what others do, without active response or resistance.

Primary Motivation

A fundamental drive or psychological need that propels an individual's behavior and actions.

Q2: The § 1202 exclusion of gain on

Q11: Erica transfers land worth $500,000,basis of $100,000,to

Q20: What are the tax consequences of a

Q32: A § 754 election is made for

Q36: Briefly describe the rationale for the reduced

Q42: Grey,Inc.,has $2 million in gross receipts of

Q48: For purposes of the penalty tax on

Q52: Dividends taxed at a 15% rate are

Q53: Payment to a limited partner for $10,000

Q104: The U.S.states apply different rules in treating