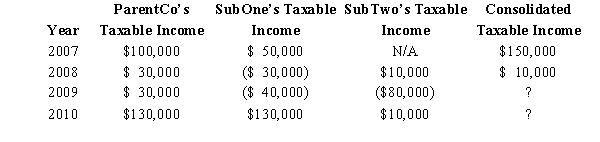

ParentCo and SubOne have filed consolidated returns since 2006.SubTwo was formed in 2009 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

If ParentCo does not elect to forgo the carryback of the 2009 net operating loss,what portion of the 2009 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Sympathy

The feelings of pity and sorrow for someone else's misfortune.

Officer Safety

The measures and practices put in place to ensure the physical and psychological well-being of law enforcement officers.

SWAT Units

Special Weapons And Tactics (SWAT) units are elite police squads trained for high-risk operations that ordinary police forces are not equipped to handle.

Deployment

The action of moving military forces or resources into position for strategic or operational purposes.

Q14: Harry and Sally are considering forming a

Q14: During 2008,Brown Corporation (a calendar year taxpayer)has

Q14: Dividend paid to parent out of parent

Q27: Type of U.S.-source income potentially taxed to

Q28: Which of the following tax items is

Q49: With respect to the AMT,what is the

Q64: A cash basis calendar year C corporation

Q65: Which could constitute a second class of

Q68: U.S.taxpayers earning income outside the United States.

Q95: Miles,Ltd.,a foreign corporation,has a U.S.branch that earns