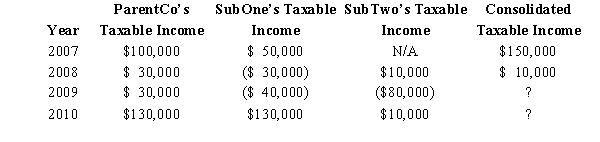

ParentCo and SubOne have filed consolidated returns since 2006.SubTwo was formed in 2009 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.

If ParentCo does not elect to forgo the carryback of the 2009 net operating loss,what portion of the 2009 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Goodwill

An intangible asset that arises when a buyer acquires an existing business, representing the value of the business's brand, customer base, and other non-physical assets.

Land Improvements

Upgrades made to land such as landscaping, irrigation systems, and construction of pathways that enhance its value and utility.

Buildings

Structures constructed on land that serve various purposes, such as commercial, residential, or industrial activities, often considered as long-term assets in financial accounting.

Land

A natural resource concerning the solid surface of the earth, which is not subject to depreciation.

Q1: Nonqualified distribution

Q12: Lacking elections to the contrary,consolidated NOLs are

Q23: The United States has income tax treaties

Q29: "Inbound" and "offshore" transfers are exempt from

Q38: Start-up costs

Q47: Earl and Mary form Crow Corporation.Earl transfers

Q82: Which,if any,of the following can be eligible

Q107: The termination of an S election occurs

Q112: A for-profit hospital can remain in the

Q146: An S corporation does not recognize gain