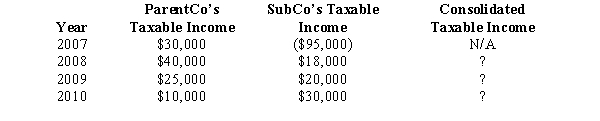

ParentCo purchased all of the stock of SubCo on January 2,2008,and the two companies filed consolidated returns for 2008 and thereafter.Both entities were incorporated in 2007.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.No § 382 limit applies.

Assuming that no election is made to forgo the carryback,to what extent are SubCo's 2007 losses used by the group in 2008-2010?

Definitions:

Justice

The principle of fairness and moral righteousness that seeks to ensure that individuals receive what they are due, both in law and equity.

Specific Performance

A legal remedy that compels a party to execute a contract according to the precise terms agreed upon, rather than paying damages.

Paralegal

A professional qualified through education, training, or work experience who assists attorneys in delivering legal services, but is not qualified to practice law.

Constitutional Law

The body of law that defines the relationship of different entities within a state, namely, the executive, the legislature, and the judiciary.

Q10: Step up

Q22: Cayenne Corporation,an accrual basis taxpayer,has struggled to

Q36: Briefly describe the rationale for the reduced

Q37: Given the following information,determine whether Greta,an alien,is

Q45: A subsidiary is liquidated pursuant to §

Q51: Gravy Corporation and Dirt Corporation enter into

Q89: During 2008,an S corporation in Gainesville,Florida,incurs the

Q90: An affiliated group exists where there is

Q103: Which of the following is false regarding

Q154: Randall owns 800 shares in Fabrication,Inc.,an S