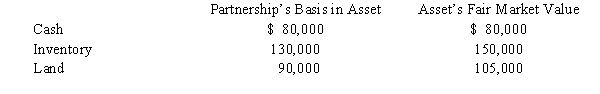

Suzy owns a 25% capital and profits interest in the calendar-year SJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating current distribution of the following assets:

a.Calculate Suzy's recognized gain or loss on the distribution, if any.

b.Calculate Suzy's basis in the inventory received.

c.Calculate Suzy's basis in land received. The land is a capital asset.

d.Calculate Suzy's basis for her partnership interest after the distribution.

Definitions:

Déjà Vu

The eerie and often unsettling feeling of having already experienced a present situation, despite it being new.

Memory Construction

The process by which the brain encodes, stores, and retrieves information to create and recreate memories.

Past Event

A specific occurrence or situation that has happened in the time before the present.

Memory Gaps

Instances where an individual cannot recall information; often due to factors like stress, trauma, or neurological issues.

Q4: Mandatory step down

Q14: Dividend paid to parent out of parent

Q16: Hot assets

Q50: Section 482 is used to:<br>A)Force taxpayers to

Q63: The ABC Partnership makes a proportionate distribution

Q66: ParentCo purchased all of the stock of

Q77: Help,Inc.,a tax-exempt organization,incurs lobbying expenses of $275,000

Q97: With respect to passive losses,there are three

Q117: Sale of the individual assets of an

Q135: Tax deferred reorganizations involving U.S.-owned foreign corporations