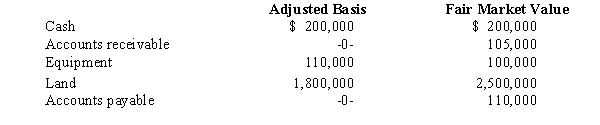

Apple,Inc.,a cash basis S corporation in Orange,Texas,formerly was a C corporation.Apple has the following assets and liabilities on January 1,2008,the date the S election is made.

During 2008,Apple collects the accounts receivable and pays the accounts payable.The land is sold for $3 million,and taxable income for the year is $590,000.What is Apple's built-in gains tax?

Definitions:

Early Childhood Experiences

Early childhood experiences encompass various events, interactions, and environments a child is exposed to from birth up until around the age of eight, which significantly influence cognitive, emotional, and social development.

Within-Family Difference

Refers to variations or disparities in traits, behaviors, or outcomes observed among members of the same family.

Child-Rearing Attitudes

The perspectives or approaches that parents and caregivers adopt in the upbringing of children.

Birth Order

The chronological order of sibling births, which is theorized to influence personality and behavior.

Q8: BoxCo,Inc.,a domestic corporation,owns 10% of the stock

Q13: Substantially appreciated inventory

Q58: Form 4720

Q60: An S shareholder's basis includes a ratable

Q63: Distributions of appreciated property by an S

Q67: General partnership.

Q75: The MBC Partnership makes a § 736(b)cash

Q116: § 501(h)

Q117: Under what part of § 501(c)are most

Q154: Randall owns 800 shares in Fabrication,Inc.,an S