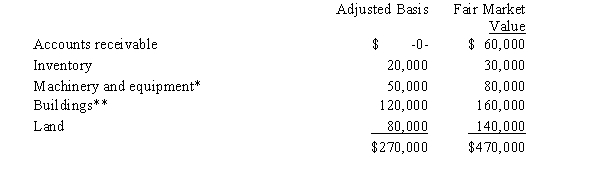

Kristine owns all of the stock of a C corporation which owns the following assets:

* Potential § 1245 recapture of $30,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $470,000.

Definitions:

Wellbeing

Refers to a state of being comfortable, healthy, or happy, encompassing both physical and psychological health.

Decentration

The cognitive ability to consider multiple aspects of a situation simultaneously, crucial for developing logic in children.

Egocentric

A developmental stage where an individual is unable to differentiate between their own perspective and that of others, often seen in early childhood.

Concrete-Operational Children

A stage in Piaget's theory of cognitive development (ages 7-12) where children gain the ability to think logically about concrete events.

Q8: Guaranteed payment

Q14: Shaker Corporation operates in two states,as indicated

Q45: Daisy,Inc.,has taxable income of $850,000 during 2008,its

Q53: PTI

Q58: The starting point in computing state taxable

Q80: When the IRS issues a notice of

Q94: Liang,an NRA,is sent to the United States

Q127: The model law relating to the assignment

Q134: If a resident alien shareholder moves outside

Q142: Identify a disadvantage of an S corporation.<br>A)Generally,