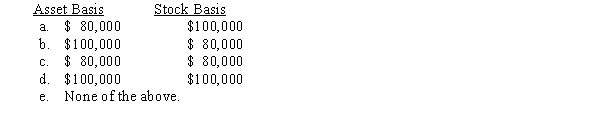

Trolette contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a C corporation and the transaction qualifies under § 351,the corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Promotional Mix

A combination of advertising, sales promotion, public relations, personal selling, and direct marketing strategies used to achieve marketing goals.

Channel Members

Individuals or entities involved in the process of making a product or service available for use or consumption by a consumer or business user.

Manufacturer

A company or entity that produces goods using raw materials, labor, and machinery, typically for sale to consumers, businesses, or other entities.

Nationwide Advertising

Marketing efforts that are spread across an entire country, aiming to reach consumers on a national level.

Q4: Mandatory step down

Q16: City and county governments depend heavily on

Q25: A distribution from previously taxed income is

Q39: Form 990-PF

Q44: In a few states,a Federal S corporation

Q48: Foreign tax credit allowed for withholding taxes

Q71: A profit-related activity of an exempt organization

Q90: All exempt organizations must obtain IRS approval

Q110: Colin and Reed formed a business entity

Q145: The taxable LIFO recapture amount equals the