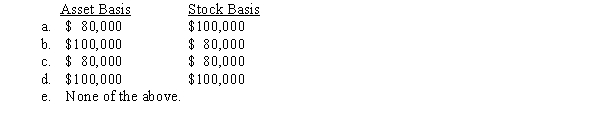

Marcus contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is an S corporation and the transaction qualifies under § 351,the S corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Rose Rosette Disease

A viral disease affecting roses, characterized by excessive thorniness, red pigmentation, and distorted growth, often leading to plant death.

Sulphur Treatment

Processes that remove sulfur compounds from various products, particularly in the oil and gas industry, to prevent pollution and corrosion.

Neem Oil Treatment

The application of neem oil, derived from the neem tree, as a natural pesticide to control pests and diseases in agriculture and horticulture.

Difference-In-Differences

Difference-in-differences is a method for identifying causality by looking at the way in which the average change over time in the outcome variable is compared to the average change in a control group.

Q4: Mandatory step down

Q17: P.L.86-272 _ (does/does not)create nexus when the

Q40: Section 1248 applies to which of the

Q53: Although Bowl Corporation's manufacturing facility,distribution center,and retail

Q54: A taxpayer's return might be selected for

Q60: An S shareholder's basis includes a ratable

Q68: Nonliquidating distribution

Q69: Kim Corporation,a calendar year taxpayer,has manufacturing facilities

Q78: A corporation that does not yet exist

Q129: The excise tax imposed on a private