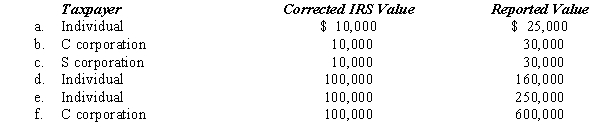

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 30%.

Definitions:

Farmers

Individuals or entities engaged in the activity of agriculture, which includes the cultivation of plants and rearing of animals for food, fiber, biofuel, medicines, and other products used to sustain and enhance human life.

Optimal Allocation

The most efficient distribution of resources within an economy to maximize the output or welfare.

MB = MC

A principle in economics indicating the optimal level of output or consumption, where the marginal benefit (MB) equals the marginal cost (MC).

Marginal Benefit

The added utility or pleasure that comes from the consumption of one more unit of a good or service.

Q21: Failure to pay over withheld tax

Q26: Kirk is establishing a business in 2008

Q27: While engaging in a prohibited transaction can

Q41: Under P.L.86-272,which of the following transactions by

Q44: Circular 230 prohibits a tax preparer from

Q52: Boot Corporation is subject to income tax

Q72: Unrelated business income is generally that derived

Q104: Under what circumstances are bingo games not

Q117: The Yellow Trust incurred $10,000 of portfolio

Q131: Harry and Brenda are husband and wife.Using