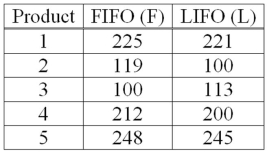

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What are the degrees of freedom?

What are the degrees of freedom?

Definitions:

Nucleus

A membrane-bound organelle found in eukaryotic cells, containing most of the cell's genetic material.

Smooth

A type of involuntary muscle tissue found in internal organs.

Walls

Structures designed to divide or enclose areas, commonly constructed from materials like brick, stone, or wood.

Organs

Structures composed of different tissues that perform specific functions within an organism, such as the heart, liver, or lungs.

Q8: Accounting procedures allow a business to evaluate

Q24: The Office of Student Services at a

Q45: In multiple regression analysis, how is the

Q59: Twenty-one executives in a large corporation were

Q67: A p-value is the same as a

Q88: A random sample of 40 companies with

Q97: The following graph is used to evaluate

Q98: The Intelligence Quotient (IQ) test scores for

Q105: What is the difference between a sample

Q120: The human resources department of a software