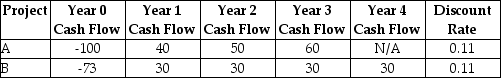

Consider the following two projects:  The net present value (NPV) of project A is closest to ________.

The net present value (NPV) of project A is closest to ________.

Definitions:

Expansion Project

A business initiative aimed at increasing the size, reach, or capabilities of the company, often requiring significant capital investment.

Capital Rationing

The process of selecting profitable projects to invest in, limited by the availability of funds.

NPV

Net Present Value, a financial metric used to evaluate the profitability of an investment, considering the time value of money.

Mutually Exclusive

Events or decisions that cannot occur or be taken simultaneously; selecting one option precludes the choice of the other.

Q3: Valence Electronics has 213 million shares outstanding.

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt=" Panjandrum Industries, a

Q13: There are four levels of measurement: qualitative,

Q43: Suppose the term structure of interest rates

Q52: The sum of the differences between sample

Q82: A sample of five full-service gasoline stations,

Q85: Treasury bonds have original maturities from one

Q102: CathFoods will release a new range of

Q109: You are considering adding a microbrewery onto

Q118: A bakery is deciding whether to buy