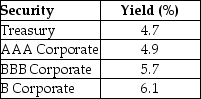

Consider the following yields to maturity on various one-year, zero-coupon securities:  The credit spread of the B corporate bond is closest to ________.

The credit spread of the B corporate bond is closest to ________.

Definitions:

Diminishing Marginal Returns

A principle stating that as additional units of a variable input are added to a fixed input, the additions to output will eventually decrease.

Law of Diminishing Returns

An economic principle stating that as investment in a particular area increases, the rate of profit from that investment, after a certain point, cannot continue to increase if other variables remain constant.

Total Cost

The aggregate of expenses related to the manufacturing of products or provision of services, which includes costs that stay the same as well as those that vary.

Fixed Costs

Expenses that do not vary with the level of production or business activity, such as rent, salaries, and insurance premiums, remaining constant regardless of output.

Q3: Valence Electronics has 213 million shares outstanding.

Q3: Which of the following statements regarding bonds

Q17: The following frequency distribution shows the distribution

Q19: Which of the following statements is FALSE?<br>A)Backdating

Q22: The one-year forward exchange rate is Rupees

Q27: You expect that Bean Enterprises will have

Q59: An oil company is buying a semi-submersible

Q66: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt=" A bakery invests

Q92: The following frequency distribution shows the distribution

Q112: What is a competitive market?<br>A)a market in