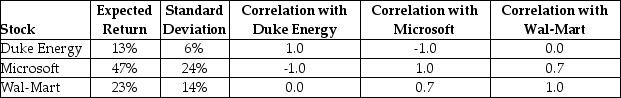

Consider the following expected returns, volatilities, and correlations:  The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

Definitions:

Economic Strategy

A plan of action designed to achieve specific financial or market objectives.

Exports

Items or services that are manufactured in one nation and purchased by consumers in a different country.

Imports

Goods or services brought into a country from abroad for sale or use.

Consumer Surplus

The difference between what consumers are willing to pay for a good or service versus what they actually pay, representing a measure of consumer benefit.

Q1: Why do the issuers of bonds not

Q2: UPS, a delivery services company, has a

Q18: Outstanding debt of Home Depot trades with

Q42: A firm issues $525 million in straight

Q42: Which of the following investments had the

Q69: In most corporations, the owners exercise direct

Q78: While we are using historic return to

Q93: A firm has a market value of

Q100: How do the transaction costs of IPO

Q108: SIROM Scientific Solutions has $5 million of