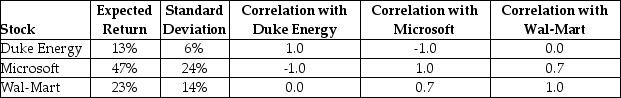

Consider the following expected returns, volatilities, and correlations:  The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to ________.

Definitions:

Unconscionable

Describes an agreement so unfair or unjust that it shocks the conscience, often deemed unenforceable by courts.

Resale of Goods

The act of selling an item that has already been purchased, typically referring to the sale of goods by businesses to consumers.

Broken Contract

A situation where one or more parties fail to fulfill the terms and conditions outlined in a legally binding agreement.

Specific Performance

A judicial order compelling a party to execute their duties as specified in a contract instead of compensating with damages for contract violation.

Q2: The firm commitment process is the most

Q7: The OLI paradigm is an attempt to

Q19: A firm's sources of financing, which usually

Q21: Which of the following statements is FALSE?<br>A)Before

Q30: Iota Industries is an all-equity firm with

Q42: The O in OLI refers to an

Q43: How does the total cost of issuing

Q55: Firms that have many divisions with different

Q71: Prada has nine million shares outstanding, generates

Q96: A bond has a face value of