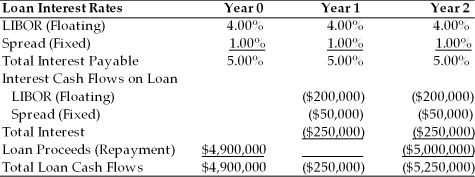

TABLE 9.1

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 9.1. If the LIBOR rate jumps to 5.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

Definitions:

Financial Statements

Formal records that outline the financial activities and condition of a business, including the balance sheet, income statement, and cash flow statement.

Unusual Item

A significant transaction or event that is infrequent in nature, distinct from the ordinary activities of the business.

Current Operations

Relates to the primary activities that a business performs to earn revenue within its normal business cycle.

Accounting Methods

Systems that companies use to record their financial transactions, such as cash basis and accrual basis accounting.

Q2: Explain what accounting is and why financial

Q4: One of the most important factors in

Q10: A/an _ quote in the United States

Q18: Which of the following is NOT an

Q19: For most firms, the cost of capital

Q23: Terrorism, cyber attacks, and the anti-globalization movement

Q25: Generally speaking, which of the following is

Q27: Consider the price elasticity of demand. If

Q48: The four currencies that constitute about 80%

Q51: Which of the following is NOT a