Willow Corp. is a real estate developer with its headquarters in Burlington, Ontario.

As a result of recent increases in land prices, Willow has accumulated a substantial amount of excess cash. It is looking to invest in a building supply company, but has not yet found a suitable company. To earn a reasonable return and to minimize risk, Willow invests its excess cash in common shares of large, stable corporations.

1. On Jan 1, 2011, Willow paid $1,080,000 to purchase 120,000 common shares of North Line.

2. On December 27, 2011, North Line declared and paid a dividend of $0.25 per common share.

3. On December 31, 2011, the market value of the common shares was $1,200,000.

4. On June 30, 2012, Willow sold the common shares for $1,620,000.

Required:

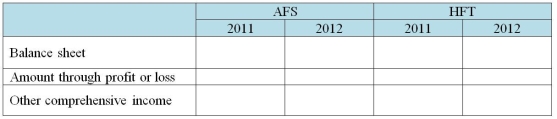

Using the following table, indicate the amounts to be reported in the balance sheet, through profit or loss, and through other comprehensive income for 2011 and 2012 under two scenarios:

a. Willow designates the common shares as an available-for-sale (AFS)investment.

b. Willow designates the common shares as a held-for-trading (HFT)investment.

Definitions:

Family Firms

Businesses owned and operated by multiple generations of a family, with decision-making influenced by familial relationships.

Second Generation

Typically refers to individuals born in a country to parents who immigrated, often experiencing a blend of cultural influences from their heritage and their country of birth.

Third Generation

In technology, often refers to the third iteration or version of a product or system, showing advancement and improvements over previous generations.

Business Success

The achievement of desired financial and non-financial objectives in a business venture, often measured by growth, profit, and market share.

Q10: Technical analysis of exchange rates developed in

Q15: The authors claim that random events, institutional

Q24: Super Corp. reported credit sales of $2,000,000,

Q84: Creation Construction Company (CCC)has contracted to build

Q92: Simply purchases a $100,000 face value bond

Q94: CeeMore owns a machine that it purchased

Q96: WestCoast Co. started a contract in June

Q116: Victoria purchases a hotel with 100 similar

Q117: What factor is not important in classifying

Q121: Which item is an example of a