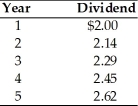

A firm has common stock with a market price of $55 per share and an expected dividend of $2.81 per share at the end of the coming year. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of the firm's common stock equity is ________.

The cost of the firm's common stock equity is ________.

Definitions:

Total Revenue

The total income received by a company from its sales of goods or services, calculated without deducting any costs or expenses.

Price Range

The spread between the highest and lowest selling price of a commodity or service over a certain period of time, reflecting its market volatility or stability.

Elasticity of Demand

A determination of the responsiveness of consumer interest in a good due to price fluctuations.

Unit Elasticity

Describes a scenario in demand or supply where the percentage change in quantity demanded or supplied is equal to the percentage change in price.

Q7: Budgets have to be exact and inflexible

Q29: The bond indenture identifies any collateral pledged

Q49: In comparing the constant-growth model and the

Q63: Which of the following is not an

Q103: What should an individual, who is claiming

Q117: Which of the following is an option

Q127: Goals with a time frame of five

Q134: The firm's cost of preferred stock is

Q171: In an inefficient market, stock prices adjust

Q186: Jenny has an annual income of $50