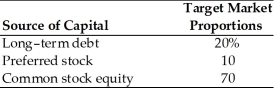

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of retained earnings is ________. (See Table 9.1)

Definitions:

Case Study

A detailed investigation into a single subject or case, often used in psychology to explore complex issues or phenomena.

IQ Test

A standardized test designed to measure human intelligence and cognitive abilities.

Social Interest Index

A measure that assesses an individual's level of social concern and investment in the welfare of others.

Superiority Feelings

Emotions or attitudes stemming from a belief or perception of being better or above others in some way.

Q22: You have constructed a portfolio of investments

Q23: Financial advisers are in demand because many

Q29: The bond indenture identifies any collateral pledged

Q45: Which of the following is true of

Q96: A(n) _ is a paid individual, corporation,

Q128: The purpose of nonvoting common stock is

Q137: Greater risk aversion results in lower required

Q155: From a corporation's point of view, a

Q164: When considering insurance coverage in your financial

Q188: Bart is not married, has an annual