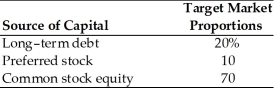

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-If the target market proportion is reduced to 15 percent, what will be the revised weighted average cost of capital? (See Table 9.1)

Definitions:

Violence Against Women Act

A landmark piece of legislation in the United States that aims to protect women from violent crimes and abuse, providing support and resources for victims.

Unconstitutionality

Unconstitutionality refers to actions, laws, or policies that are deemed to violate the principles or specific provisions laid out in a country's constitution.

Federal Taxation

The levying of taxes by the federal government to fund national programs and services.

U.S. Constitution

The supreme law of the United States, establishing the framework of government, the distribution of powers, and protecting citizens' rights.

Q28: The _ describes the relationship between nondiversifiable

Q45: The income in your budget is not

Q63: As a bond approaches maturity, the price

Q89: Any action taken by a financial manager

Q92: Given the bank rate of 3.5 percent,

Q104: Beta coefficient is an index that measures

Q155: From a corporation's point of view, a

Q175: Tangshan China's stock is currently selling for

Q184: Cumulative preferred stocks are preferred stocks for

Q188: A(n) _ yield curve reflects lower expected