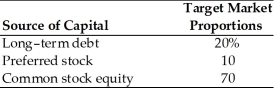

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-If the target market proportion is reduced to 15 percent, what will be the revised weighted average cost of capital? (See Table 9.1)

Definitions:

Reasoning

The mental process of generating conclusions, judgments, or inferences from facts or premises.

Memory

The process by which information is encoded, stored, and retrieved, allowing individuals to retain knowledge and experiences over time.

Emotion

A complex reaction pattern, involving experiential, behavioral, and physiological elements, by which an individual attempts to deal with a personally significant matter or event.

Substantia Nigra

A region of the brain involved in movement and reward, known for its role in disorders such as Parkinson's disease.

Q10: The capital asset pricing model describes the

Q26: A firm has issued cumulative preferred stock

Q53: Identify whether the key characteristic describes common

Q69: The cost of new common stock is

Q72: The CAPM is based on an assumed

Q79: The weights used in weighted average cost

Q91: The beta of the portfolio in Table

Q117: If you were to create a portfolio

Q171: Which of the following is not a

Q211: An A rated bond should provide investors