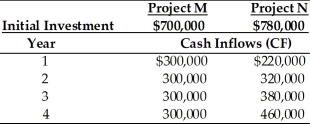

Table 12.3

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the NPV for Project N is ________. (See Table 12.3)

Definitions:

Human Resources

The department within an organization that focuses on recruiting, managing, and directing people who work in it. They handle issues related to employment, such as compliance with labor laws and employment standards, administration of employee benefits, and some aspects of recruitment and dismissal.

Sales Meetings

Gatherings or conferences held with the goal of discussing sales performance, strategies, and objectives.

Disruptive Innovation

An innovation that significantly alters the way that businesses operate, creating new markets and displacing established market leading firms and products.

Q5: If an asset is sold for less

Q55: _ leverage is concerned with the relationship

Q61: Which of the following activities of a

Q70: What is the IRR for the following

Q77: The higher the risk of a project,

Q81: Dividends provide information about a firm's current

Q86: The net present value without adjusting the

Q92: A firm has fixed operating costs of

Q93: A corporation has $5,000,000 of 8 percent

Q114: The financial manager of a firm prepares