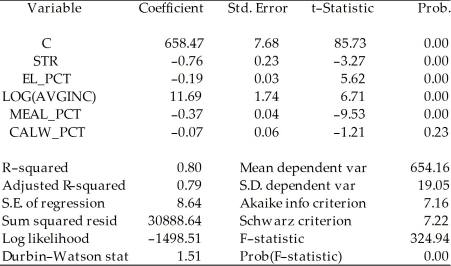

Consider the regression output from the following unrestricted model:

Unrestricted model:

Dependent Variable: TESTSCR

Method: Least Squares

Date: 07/31/06 Time: 17:35

Sample: 1 420

Included observations: 420  To test for the null hypothesis that neither coefficient on the percent eligible for subsidized lunch nor the coefficient on the percent on public income assistance is statistically significant, you have your statistical package plot the confidence set. Interpret the graph below and explain what it tells you about the null hypothesis.

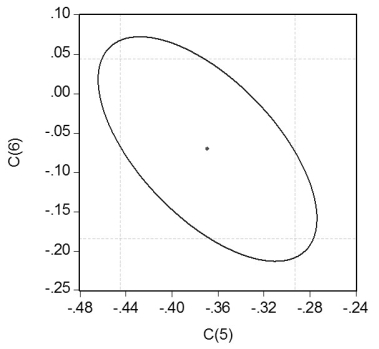

To test for the null hypothesis that neither coefficient on the percent eligible for subsidized lunch nor the coefficient on the percent on public income assistance is statistically significant, you have your statistical package plot the confidence set. Interpret the graph below and explain what it tells you about the null hypothesis.

Definitions:

Past Data

Refers to historical information or records that have been collected and archived, which can be used for analyzing trends, making predictions, or understanding historical contexts.

Future

A period of time that has not yet happened but will come after the present.

Marketing Researchers

Professionals specialized in gathering, analyzing, and interpreting data about markets, consumers, and trends to inform business decisions.

Willingness to Buy

The extent to which a consumer is ready to purchase a product or service, based on factors like price, quality, and personal preference.

Q2: Assume that you have 125 observations

Q5: (Requires Appendix material)The following are examples of

Q18: The ADL(p,q)model is represented by the following

Q20: Your textbook estimates the initial relationship

Q26: Multiplying the dependent variable by 100 and

Q37: A distributed lag regression<br>A)is also called AR(p).<br>B)can

Q38: To measure the fit of the probit

Q39: Assume that two presidential candidates, call

Q47: In panel data, the regression error<br>A)is likely

Q53: Prove that <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5979/.jpg" alt="Prove that