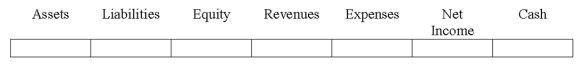

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.Enter only one letter for each element.You do not need to enter amounts.

-Gable Company collected a receivable due from a credit card transaction company;the credit card fee had previously been recognized when the sale was recorded.Show the effect of collection of the receivable on Gables financial statements.

Definitions:

Cost Per Equivalent Units

A method used in process costing that calculates the cost assigned to units produced during a period, considering partially completed units as fractions of whole units.

Weighted Average Method

An inventory valuation method that calculates the cost of goods sold and ending inventory balance using a weighted average of the costs of all items available for sale during the period.

FIFO Costing

An inventory valuation method that assumes that the first items placed in inventory are the first ones sold, standing for First In, First Out.

Unit Costs

The cost incurred by a company to produce, store, and sell one unit of a particular product or service.

Q26: Accounts receivable turnover is computed by dividing:<br>A)Sales

Q51: The following is a random list of

Q59: Belvedere Company recognized $2,500 of depreciation expense

Q88: Indicate whether each of the following statements

Q99: Benitez Co.had sales of $800,000 in 2016.The

Q112: Byrd Company experienced an accounting event that

Q113: How do the percent of revenue method

Q115: During a period of rising prices,a company's

Q131: Adjusting entries are made at the end

Q135: The accounting records of the Harris and