Use the following to answer questions

On December 31,2015,the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible.Loudoun uses the allowance method of accounting for uncollectible accounts.In February 2016,one of Loudoun's customers failed to pay his $1,050 account and the account was written off.On April 4,2016,this customer paid Loudoun the $1,050.

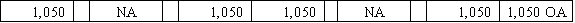

-Which of the following answers correctly states the effect of recording the collection of the reestablished receivable on April 4,2016?

Definitions:

Variable Costing

An accounting method that considers only variable costs as product costs and treats fixed costs as period costs.

Direct Costing

An accounting method that identifies variable costs directly associated with production and excludes fixed costs from product costing.

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - in the cost of a product.

Variable Costing

An accounting method that charges only variable production costs to units produced and treats fixed manufacturing overhead as a period expense.

Q7: Which of the following statements is not

Q8: The employees of Able Company have worked

Q20: Indicate the effect of debits or credits

Q21: Following the February bank reconciliation,the accountant made

Q60: Explain the computation of the inventory amount

Q66: What accounting steps would a firm normally

Q71: Which of the following answers correctly states

Q104: The depreciable cost of a long-term asset

Q140: Even a good system of internal controls

Q140: On December 31,2016,Briand Co.paid cash for interest