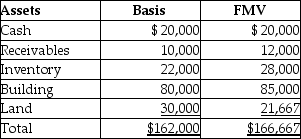

The LM Partnership terminates for tax purposes on July 15 when Latasha sells her 60% capital and profits interest to Zoe for $100,000.The partnership has no liabilities,and its assets at the time of termination are as follows:

Marika,a 40% partner in the LM Partnership,has a $64,800 basis in her partnership interest (outside basis) at the time of the termination.She has held her LM Partnership interest for three years at the time of the termination.The bases of Marika and Zoe in the new LM Partnership is:

Definitions:

Single Amount

A lump-sum value; referring to a financial transaction or an accounting entry that involves only one amount rather than multiple payments or amounts.

Concept

An abstract idea or a general notion representing something, often used as a foundational principle or theory.

Semiannual Deposits

Payments or savings contributions made twice a year into a particular account or investment.

Annual Interest

The amount of interest due over the course of a year as a result of borrowing funds or investing, expressed typically as a percentage of the principal.

Q4: The payment date for estate taxes may

Q4: Identify which of the following statements is

Q27: A trust is required to distribute all

Q27: Mary,a U.S.citizen,owned 25% of the stock of

Q37: Identify which of the following statements is

Q77: Identify which of the following statements is

Q83: Which of the following best describes the

Q96: Robert Elk paid $100,000 for all of

Q118: Users of NYTimes.com can access the book

Q266: Marketers produce a customer experience through seven