On January 2,20X6,the Exeter Golf and Country Club was formed and registered as a non-profit organization.In May 20X6,the Club purchased a golf course near Exeter for $5,000,000.The purchase price was financed with an 8% mortgage loan of $4,500,000 and $500,000 contributed by the founding members.The mortgage was repayable over 25 years.The $500,000 contribution from the founding members was an interest-free loan repayable over 5 years.

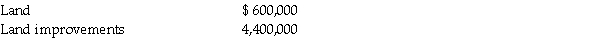

The Club and vendor of the golf course agreed that the $5,000,000 purchase price would be split as follows:

The land improvement costs include the costs of developing the golf course.Experts in the field estimate that major costs are incurred approximately every 25 years to redevelop a golf course.

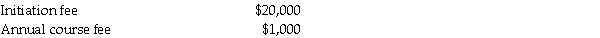

During 20X6,the membership fees were established for the Club as follows:

The initiation fee entitles the member to lifetime membership in the Club and to a vote at the annual general meeting.The Club hopes to sell 400 of these lifetime memberships over the next 2 years in order to pay off the existing loans and provide $3,000,000 for development of a clubhouse.The annual course fee is due by April 1 of each year.It entitles the member to golf at the Club throughout the year.If the member pays the annual course fee prior to January 31,the fee is reduced to $950.It is expected that 60% of the members will take advantage of the early payment discount.

The Club's president has approached you asking for assistance in establishing the accounting policies for the Club for its yearly financial statements.

Required:

Assume that the Club has decided to amortize the land improvement costs over 25 years,the clubhouse over 40 years,and to use the deferral method of accounting for contributions.Provide recommendations with supporting arguments for the accounting treatment of the initiation fees and annual fees.

Definitions:

Performance Strategy

refers to a plan of action aimed at enhancing the efficiency and effectiveness of an individual, team, or organization.

Ample Resources

refers to having a sufficient or generous amount of resources available, including financial, material, and human, to achieve desired goals or objectives.

Intra-team Trust

The degree of confidence among team members that their peers will act in the team's interest and fulfill their responsibilities.

Specialized Member Skills

Specific abilities and expertise possessed by individuals within a team or organization that contribute to achieving complex tasks or objectives.

Q3: On January 1,20X7,Water Limited purchased 700,000 shares

Q5: On December 31,20X2,the Esther Company purchased 80%

Q15: The Wellness Society,a not-for-profit organization,owns 25% of

Q22: Sya Ltd.acquired all the assets and liabilities

Q27: Townsend Ltd.has the following shareholders:<br>Palermo Co.- 60%<br>Nix

Q74: Which of the following people would MOST

Q132: Which of the following terms best describes

Q177: Figure 1-5 above,"A" represents which era in

Q190: Organizations such as American Airlines,U.S.Bank,and Red Cross

Q255: Which of the following organizations engage in