DNA was incorporated on January 2,20X0 and commenced active operations immediately.Common shares were issued on the date of incorporation and no new common shares have been issued since then.On December 31,20X3,INT purchased 70% of the outstanding common shares of DNA for 800,000 Swiss francs (CHF).

DNA's main operations are located in Switzerland.For the year ending December 31,20X6,the income statement (in 000s)for DNA was as follows:

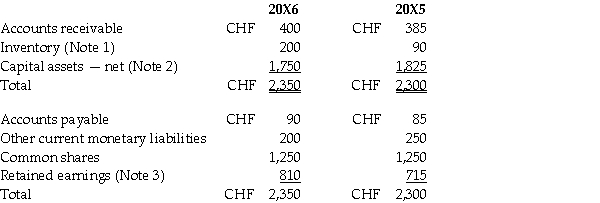

The comparative and condensed statements of financial position (in 000s)for DNA were as follows:

OTHER INFORMATION:

• Purchases and sales of merchandise inventory occurred evenly throughout the year.

• The ending inventory was purchased evenly throughout the last month of the year.

• DNA had purchased the capital assets on hand at the end of 20X6 on March 17,20X1.There were no purchases or sales of capital assets from 20X3 to 20X6.

• Dividends were paid on June 30,20X6.

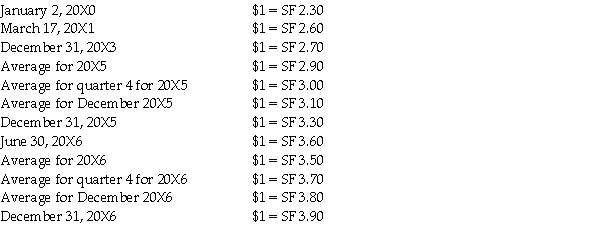

Assume that foreign exchange rates were as follows:

DNA's financial statements need to be translated into Canadian dollars for consolidation with INT's financial statements.

Required:

Calculate the exchange gain/loss on current monetary items for 20X6 under the temporal method.

Definitions:

Self-Images

Individuals’ perceptions and evaluations of themselves, encompassing both physical and psychological aspects.

Self-Affirming Task

An activity designed to promote self-validation and reinforce positive self-image.

Self-Serving Bias

The common tendency for individuals to attribute their successes to internal factors while blaming external factors for their failures.

Grade Point Averages

A numerical calculation representing the average result of all the grades achieved in coursework over time, used to assess academic performance.

Q3: The Khoo Music Society,a not-for-profit organization,is purchasing

Q6: Frey Ltd.acquired 70% of Sabo Ltd.on January

Q8: In preparing consolidation working papers,why is it

Q20: Implementation of IBM's "Smarter Planet" strategy has

Q20: How are most significant influence investments in

Q24: Grayson Ltd.acquired 60% of the outstanding common

Q29: Which financial reporting approach has Canada decided

Q175: & Jerry's introduces products like its Goodbye

Q222: Figure 1-3 above,"B" is accomplished by _.<br>A)

Q254: Figure 1-2 above,"C" represents a firm's ownership