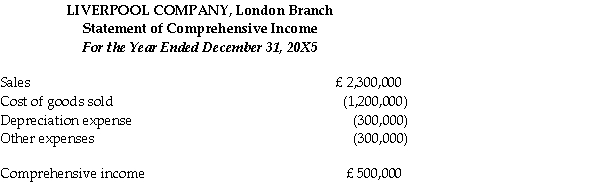

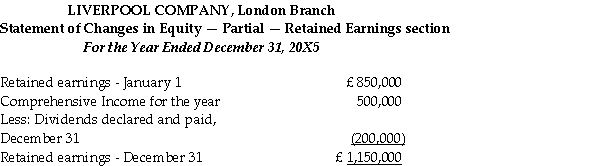

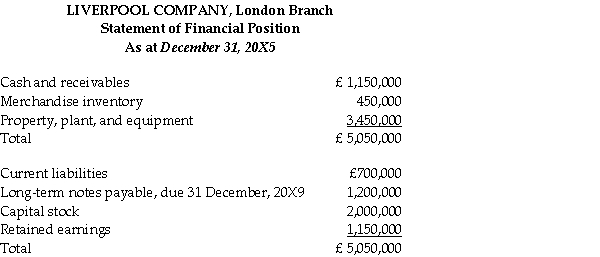

Liverpool Company operates retail stores in Canada and an exporting business in London that specializes in buying and selling British tweeds.The London subsidiary provided the following financial statements in pounds sterling to the Canadian parent company.

Liverpool Company was incorporated on January 1,1984,at which time an amount of property,plant,and equipment with a present (December 31,20X5)Net Book Value of £3,000,000 was purchased.Additional equipment was purchased December 31,20X4 (20% of depreciation expense relates to this new equipment).The long-term notes were issued,to replace financing provided by the parent,on January 1,20X4.

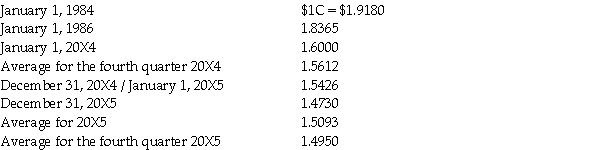

Direct exchange rates for the pound sterling (1 $C/£ )are:

The January 1,20X5 retained earnings balance of the London Branch of the Liverpool Company correctly translated to Canadian dollars was $1,783,774.The beginning inventory of £380,000 was acquired during the last quarter of 20X4 and the ending inventory was acquired during the last quarter of 20X5.Sales and purchases were made,and other expenses were incurred,evenly throughout the year.

Required:

Compute the gain or loss on holding net monetary items for the Liverpool Company for the year ending December 31,20X5.

Definitions:

Compliment

A polite expression of praise or admiration.

Favor

An act of kindness beyond what is due or usual.

Strong Points

The aspects or characteristics of something or someone that provide an advantage or superior capability.

Deliberate Self-destruction

Intentionally causing harm or damage to oneself, often as a form of coping with distress or mental health issues.

Q10: When the International Accounting Standards Board amends

Q12: Which of the following is an indication

Q13: societal marketing concept<br>A) is the moral principles

Q25: What is a currency swap an example

Q27: Tooker Co.acquired 80% of the outstanding common

Q28: The Amazing Widget Company issues $500,000 of

Q30: Which of the following is not a

Q140: organization with a market orientation<br>A) focuses its

Q145: When a bond is sold,the selling price

Q179: Whether an individual is buying for personal