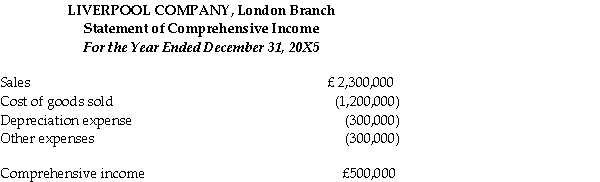

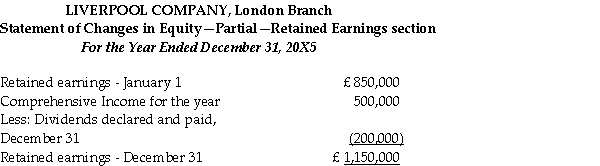

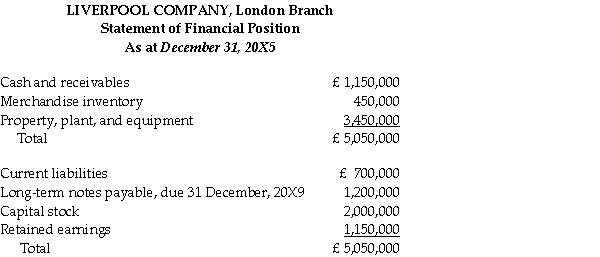

Liverpool Company operates retail stores in Canada and an exporting business in London that specializes in buying and selling British tweeds.The London subsidiary provided the following financial statements in pounds sterling to the Canadian parent company.

Liverpool Company was incorporated on January 1,1984,at which time an amount of property,plant,and equipment with a present (December 31,20X5)Net Book Value of £3,000,000 was purchased.Additional equipment was purchased December 31,20X4 (20% of depreciation expense relates to this new equipment).The long-term notes were issued,to replace financing provided by the parent,on January 1,20X4.

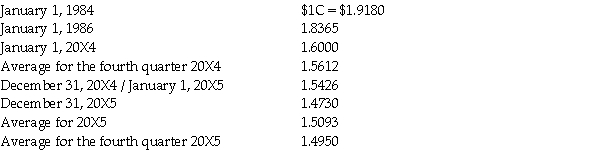

Direct exchange rates for the pound sterling (1 $C/£ )are:

The January 1,20X5 retained earnings balance of the London Branch of the Liverpool Company correctly translated to Canadian dollars was $1,783,774.The beginning inventory of £380,000 was acquired during the last quarter of 20X4 and the ending inventory was acquired during the last quarter of 20X5.Sales and purchases were made,and other expenses were incurred,evenly throughout the year.

Required:

Translate the December 31,20X5 statement of financial position of Liverpool Company into dollars assuming that the temporal method is appropriate.

Definitions:

Straight-Line Depreciation

A method of calculating the depreciation of an asset which assumes the asset will lose an equal amount of value each year over its useful life.

Tax Rate

The percentage at which an individual or corporation is taxed by the government on their income or profits.

Q18: At December 31,20X0,Crowe Company has 80,000 common

Q23: Which financial statements are recommended by the

Q26: After the first interest payment on

Q31: What is the effect of fluctuations in

Q32: _ is a plan that integrates the

Q34: Which of the following accounts would be

Q88: On January 1,2013,Davie Services issued $20,000

Q93: unique combination of benefits received by targeted

Q250: element of the marketing mix that describes

Q292: Consider Figure 2-7 above.A Florida-based flashlight company