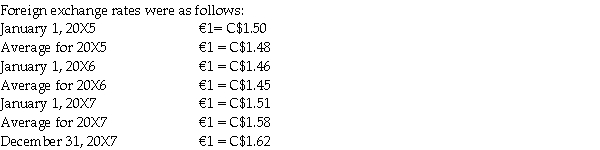

Water Bottling Inc.(WBI)is a 100% wholly owned subsidiary with operations in France.WBI was purchased by a Canadian parent on January 1,20X5.The financial records of WBI are maintained in euros and provide the following information with respect to equipment,intangibles and goodwill.

Equipment - purchased on January 1,20X5 for €250,000 - depreciated over 5 years on a straight-line basis.

Equipment - purchased on January 1,20X6 for €175,000 - depreciated over 5 years on a straight-line basis.

Required:

Assume that WBC's functional currency is the Canadian dollar.Calculate the translated Canadian dollar balances for the following accounts for December 31,20X7

a.Equipment

b.Accumulated depreciation - equipment

c.Depreciation expense

Definitions:

Sherman Act

A landmark federal statute in the field of United States antitrust law passed by Congress in 1890 to prohibit monopolistic business practices.

Monopoly Power

Monopoly power refers to the ability of a single seller or company to control the market for a particular good or service, allowing it to set prices above competitive levels.

Unreasonably Restrain

To limit or control someone or something to an excessive or unjustifiable extent, typically in a legal or regulatory context.

Microsoft Antitrust Case

A legal case in which Microsoft was accused of holding a monopoly in PC operating systems, leading to significant legal and regulatory outcomes for the company.

Q3: What is a coattail provision?<br>A)It allows preferred

Q4: On September 1,20X7,Spike Limited decided to buy

Q4: In 20X5,Bing created a wholly owned subsidiary

Q9: Under IAS 34,companies generally should use the

Q14: Raj Co.acquired all of Event Ltd.'s common

Q36: Marketing refers to<br>A) the production of products

Q75: Explain the difference between a market and

Q178: Shortly after World War II,Sam Jackson developed

Q196: Medtronic is the world leader in producing

Q281: Quadrant "A" in Figure 2-7 above represents