In 20X5,Bing created a wholly owned subsidiary called Bango Limited.Bing is a private company and reports under ASPE.Bing is currently using the cost method to record its investment in Bango,but is trying to decide if it should report using the equity method or the consolidation method.This is the only subsidiary that Bing has.

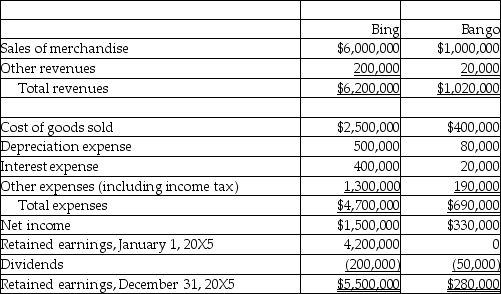

Statements of Earnings and Retained Earnings for Bing and Bango

for the year ended December 31,20X5.

Other Information

During the year,the following transactions occurred between the two companies:

1.Bing sold merchandise to Bango for $560,000.At the end of the year,Bango still owed Bing $25,000 for this merchandise.

2.Bango charged rent of $20,000 to Bing for office space.

3.Licensing fees were paid by Bango to Bing in the amount of $150,000.

Required:

(a)Prepare the Statement of Earnings and Retained Earnings for Bing using the equity method of reporting its investment in Bango.

(b)Prepare the Consolidated Statement of Earnings and Retained Earnings for Bing.

(c)Compare the equity method and the consolidation method and discuss any similarities and differences.

(d)If Bing had other subsidiary investments,what other factors would be considered in trying to decide if the consolidation or equity method should be used?

Definitions:

Freewheel

Freewheel refers to a mechanism in a bicycle, motorcycle, or vehicle allowing the wheels to rotate freely without engaging the drivetrain, especially when moving downhill or when not pedaling.

Lock-up Phase

The lock-up phase refers to a stage in automatic transmission where the torque converter locks, directly connecting the engine to the transmission to improve efficiency.

Vortex Flow

The rotational movement of a fluid, often characterized by a spiral pattern of flow lines.

Full Stall

A condition where an engine stops running or is unable to produce power under load, sometimes used in reference to torque converter performance in vehicles.

Q16: On December 31,20X2,the Esther Company purchased 80%

Q19: Sue works 46 hours at her job

Q21: Which of the following would be a

Q36: Under the discrete approach to the preparation

Q42: An asset costs $80,000 and has a

Q50: In which of the following periods should

Q65: FUTA (federal unemployment compensation)tax is paid by

Q102: Art Parrish,the sole employee of Parrish

Q107: A certain contingent liability was evaluated at

Q150: 0 What amount should be recorded as