DNA was incorporated on January 2,20X0 and commenced active operations immediately.Common shares were issued on the date of incorporation and no new common shares have been issued since then.On December 31,20X3,INT purchased 70% of the outstanding common shares of DNA for 800,000 Swiss francs (CHF).

DNA's main operations are located in Switzerland.For the year ending December 31,20X6,the income statement (in 000s)for DNA was as follows:

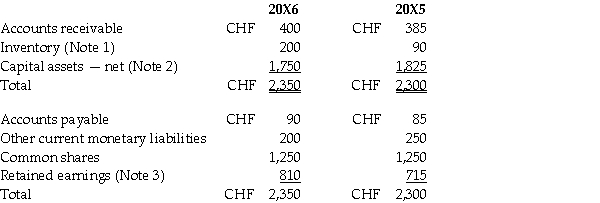

The comparative and condensed statements of financial position (in 000s)for DNA were as follows:

OTHER INFORMATION:

• Purchases and sales of merchandise inventory occurred evenly throughout the year.

• The ending inventory was purchased evenly throughout the last month of the year.

• DNA had purchased the capital assets on hand at the end of 20X6 on March 17,20X1.There were no purchases or sales of capital assets from 20X3 to 20X6.

• Dividends were paid on June 30,20X6.

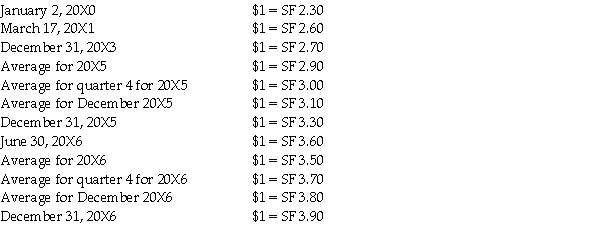

Assume that foreign exchange rates were as follows:

DNA's financial statements need to be translated into Canadian dollars for consolidation with INT's financial statements.

Required:

Calculate the exchange gain/loss on current monetary items for 20X6 under the temporal method.

Definitions:

Quantity Variance

A variance that is computed by taking the difference between the actual quantity of the input used and the amount of the input that should have been used for the actual level of output and multiplying the result by the standard price of the input.

Standard Quantity

The expected or planned amount of materials or inputs required for the production of a unit of product, based on efficient operations.

Actual Quantity

The real amount or volume of inputs used in the production process, as opposed to the amount budgeted or planned.

Standard Cost Card

A detailed listing of the standard amounts of inputs and their costs that are required to produce one unit of a specific product.

Q4: Which of the following is not one

Q5: The Khoo Music Society,a not-for-profit organization is

Q5: How should goodwill acquired in a business

Q17: Which of the following statements about non-monetary

Q21: two central concerns of marketing are _.<br>A)

Q23: For international standards to be applied effectively,a

Q28: Which of the following statements about the

Q34: Blanding Company issues $1,000,000 of 8%,10-year bonds

Q41: When is it not appropriate to use

Q93: The difference between a mortgage payable and