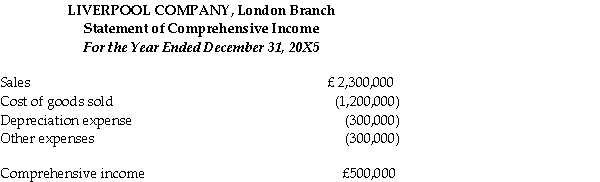

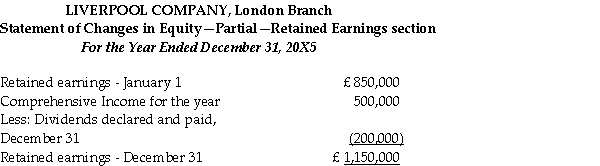

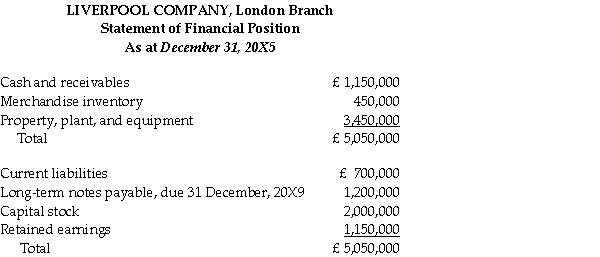

Liverpool Company operates retail stores in Canada and an exporting business in London that specializes in buying and selling British tweeds.The London subsidiary provided the following financial statements in pounds sterling to the Canadian parent company.

Liverpool Company was incorporated on January 1,1984,at which time an amount of property,plant,and equipment with a present (December 31,20X5)Net Book Value of £3,000,000 was purchased.Additional equipment was purchased December 31,20X4 (20% of depreciation expense relates to this new equipment).The long-term notes were issued,to replace financing provided by the parent,on January 1,20X4.

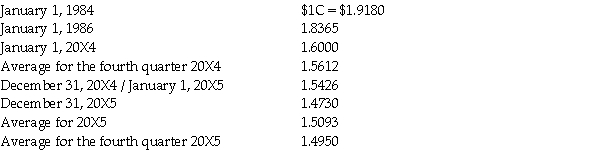

Direct exchange rates for the pound sterling (1 $C/£ )are:

The January 1,20X5 retained earnings balance of the London Branch of the Liverpool Company correctly translated to Canadian dollars was $1,783,774.The beginning inventory of £380,000 was acquired during the last quarter of 20X4 and the ending inventory was acquired during the last quarter of 20X5.Sales and purchases were made,and other expenses were incurred,evenly throughout the year.

Required:

Translate the December 31,20X5 statement of financial position of Liverpool Company into dollars assuming that the temporal method is appropriate.

Definitions:

Direct Write-Off Method

An accounting practice where specific bad debts are written off against income at the time they are deemed to be uncollectable.

Generally Accepted Accounting Principles

Generally Accepted Accounting Principles (GAAP) are a set of rules, standards, and procedures established for accounting and financial reporting, aimed at ensuring consistency and transparency.

Factoring

A financial transaction in which a business sells its accounts receivable (invoices) to a third party (factor) at a discount, to obtain immediate cash.

Direct Write-Off Method

An accounting method where bad debts are written off as an expense only when they are deemed to be uncollectable.

Q1: Under IFRS 3,Business Combinations,which method must be

Q3: Which of the following statements is true

Q18: What can the non-financial assets of a

Q24: To enhance users' abilities to evaluate a

Q27: Which era of U.S.business history does the

Q28: IFRS 8 requires the disclosure of certain

Q40: IQ has a wholly owned subsidiary in

Q58: Paris Company buys a building on

Q140: organization with a market orientation<br>A) focuses its

Q254: Figure 1-2 above,"C" represents a firm's ownership