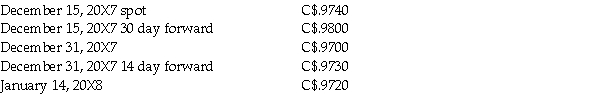

Helvetia Corp. ,a Swiss firm,bought merchandise from Bouchard Company of Quebec on December 15,20X7 for 20,000 CHF,payable on January 14,20X8.Bouchard and Helvetia both close their books on December 31.The 20,000 CHF was paid on January 14,20X8.The exchange rates for CHF1 were:

Required:

Provide the journal entries for Bouchard (the seller)at each of the above dates,as required.The account was hedged by Bouchard through a 30 day forward contract.Bouchard uses the gross method to record hedge transactions.Bouchard reports under IFRS.

Definitions:

Current Position Analysis

Current position analysis is a review of the operations, resources, and financial health to evaluate a company's current state.

Return

The income produced by an investment, typically expressed as a percentage of the investment’s cost.

Total Assets

The sum of all assets owned by a company, including cash, investments, equipment, and real estate.

Profitability

A measure of how efficiently a company or project generates profit in relation to its revenue or investments.

Q18: marketing mix refers to<br>A) the selection of

Q33: On December 31,20X5,Space Co.purchased 100% of the

Q45: Which of the following is an example

Q62: common factor among an organization's chairman of

Q80: Which of the following conditions is necessary

Q140: organization with a market orientation<br>A) focuses its

Q171: process of taking wool off sheep and

Q198: Effective marketing benefits society because it<br>A) reduces

Q247: Describe two different target markets for two

Q259: factors are required for marketing to occur: