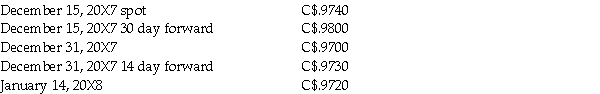

Helvetia Corp. ,a Swiss firm,bought merchandise from Bouchard Company of Quebec on December 15,20X7 for 20,000 CHF,payable on January 14,20X8.Bouchard and Helvetia both close their books on December 31.The 20,000 CHF was paid on January 14,20X8.The exchange rates for CHF1 were:

Required:

Provide the journal entries for Bouchard (the seller)at each of the above dates,as required.The account was not hedged by Bouchard.

Definitions:

Term Structure

The arrangement or relationship between interest rates and the time to maturity of debt securities.

Interest Rates

The cost of borrowing money or the return on an investment, usually expressed as a percentage per annum.

Yield Curve

A graphical representation of the interest rates on debts for a range of maturities, showing the relationship between interest rates and the term of the debt.

Expectations Theory

A theory suggesting that the interest rates on long-term bonds will reflect expected future short-term rates.

Q3: One of the largest sources of revenue

Q3: Under IAS 27,where does the non-controlling interest

Q23: After an exchange of shares in a

Q28: Bates Ltd.owns 60% of the outstanding common

Q28: Explain the marketing program that 3M used

Q31: Discount on bonds payable is considered to

Q33: The thresholds for segmental financial reporting exclude

Q40: IQ has a wholly owned subsidiary in

Q56: element of the marketing mix that describes

Q151: Dick's Sporting Goods carries baseballs all year