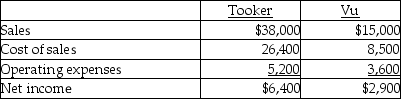

Tooker Co.acquired 80% of the outstanding common shares of Vu Ltd.There were no fair value increments or goodwill that arose with the purchase.During 20X1,Tooker sold $7,000 of inventory to Vu for a gross profit of 40%.At the end of 20X1,$3,000 of the inventory is still in Vu's inventory.On their single-entity income statements for 20X1,Tooker and Vu reported the following:

Vu sold all the goods from Tooker that were in its opening inventory.There were no sales between Tooker and Vu in 20X2.At the end of 20X2,what portion of consolidated net income is attributable to Tooker?

Definitions:

Prepayment

Payment made for goods or services before they are received or required.

Discounting

The process of determining the present value of a payment or a series of payments that will be made in the future.

Maturity Value

The amount payable to the investor at the end of a debt instrument's holding period or term.

Compounded Monthly

interest earned or paid is calculated and added to the account balance every month.

Q7: Describe the four fundamental ways in which

Q7: Faulk Ltd.has provided the following information:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1557/.jpg"

Q12: Gunnar Ltd.owns 100% of the common shares

Q12: _ is a need that is shaped

Q17: Which of the following statements about non-monetary

Q18: Pal Co.owns 70% of the outstanding common

Q33: On September 1,20X5,Hot Limited decided to buy

Q39: In preparing financial statements with cash flow

Q92: On December 31,2013,Peterson Sales has a bonds

Q204: addition to consumers,what other people,groups,and environmental forces