On September 1,20X5,Hot Limited decided to buy 80% of the shares outstanding of Cold Inc.for $850,000.Hot paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,Hot determines that some of the assets of Cold have fair values different from their carrying values.These items are listed below:

• Inventory has a fair value of $130,000

• The building has a fair value of $1,090,000.The remaining useful life of the building is 20 years.The accumulated depreciation on the building at the time of acquisition was $50,000.

• A trademark has a fair value of $300,000.The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due in August 31,20X9.

During the 20X9 fiscal year,the following events occurred:

1.Hot sold merchandise to Cold for $200,000.Profit margin on these sales is 30%.Cold still has inventory on hand of $70,000.Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000.The gross profit margin on these sales was 30%

2.Cold sold merchandise to Hot for $500,000.The gross margin on these sales was 40%.At the end of the year,$180,000 of this was still in Hot's inventory.Included in the opening inventory of Hot for 20X9 was merchandise purchased from Hot in 20X8 for $230,000.The profit margin on these sales had been 30%.

3.During 20X9,Cold sold to Hot equipment resulting in a gain to Cold of $75,000.At the time,the original cost and accumulated depreciation to date for the equipment on the Cold's books was: $510,000 and 160,000.The remaining useful life for this equipment is 15 years.Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4.During 20X9,Cold paid management fees of $450,000 to Hot.

5.During 20X9,Cold paid dividends of $400,000 and Hot paid dividends of $600,000

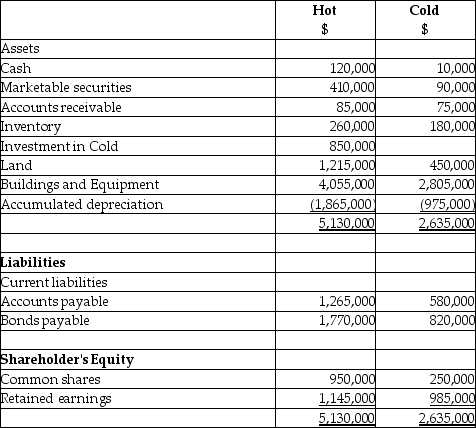

Statements of Financial Position

As at August 31,20X9

Statements of Comprehensive Income

For the year ended August 31,20X9

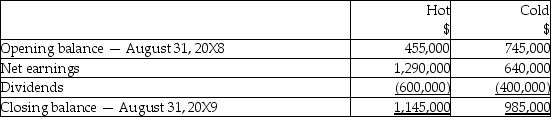

Statements of Changes in Equity - partial section - Retained Earnings

For the year ended August 31,20X9

Required:

Prepare the consolidated statement of comprehensive income and the consolidated statement of changes in equity - partial section for retained earnings for Hot as at August 31,20X9.

Calculate the non-controlling interest's portion of net earnings for the year.Calculate the opening retained earnings balance as at August 31,20X8.

The company uses the parent company extension approach to determining goodwill.

Definitions:

Growing Old

The natural process of aging, characterized by gradual changes in physical, cognitive, and social capabilities over time.

Incurable Disease

A disease that cannot be cured or adequately treated and that is likely to cause the death of the patient or a chronic condition that a patient will have to live with for the rest of their lives.

Deliberate Ending

An intentional termination or conclusion of a process, project, or relationship.

Euthanasia

The practice of intentionally ending a life to relieve pain and suffering; often discussed in the context of terminal illness.

Q2: Which of the following financial statements would

Q5: On December 31,20X1,the Dad Ltd.purchased 100% of

Q8: Sya Ltd.acquired all the assets and liabilities

Q14: Faulk Ltd.has provided the following information:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1557/.jpg"

Q22: On January 1,20X7,Clock Inc.of Vancouver,British Columbia,purchased 75%

Q53: Which of the following accounting principles requires

Q81: On January 1,2014,Partridge Company issued $50,000 of

Q98: Which of the following is included in

Q142: Blanding Company issues $1,000,000 of 8%,10-year bonds

Q152: five major environmental forces in a marketing