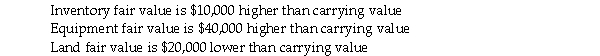

Prawn Corporation owns 80 percent of the outstanding voting shares of Shrimp Corporation,having acquired its interest January 1,20X3 for $100,000.At the time of the acquisition,Shrimp Corporation had a shareholder's equity totalling $150,made up for retained earnings of $30,000 and common shares of $20,000.The following accounts had fair values higher (or lower)than it's carrying values:

The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill.

Additional Information:

1.Shrimp had reported $50,000,relating to land (40%)and building (60%)sold to Prawn on January 3,20X5.These separate properties had not been owned on January 1,20X3.Remaining useful life was expected to be 10 years at that time.

2.Shrimp sold other land to a non-related company at a gain of $20,000 on June 30,20X6.

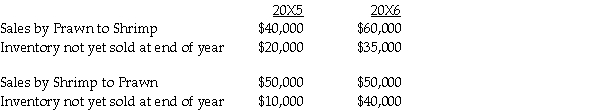

3.Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

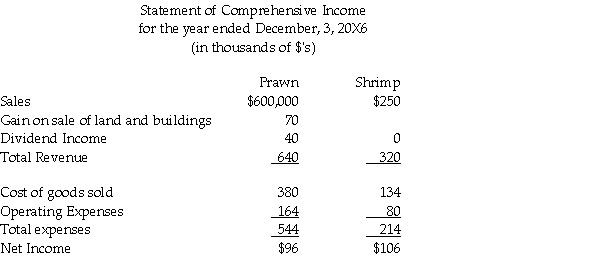

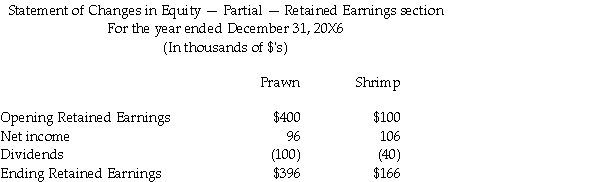

Prepare a complete consolidated Statement of Comprehensive Income for the year ending December 31,20X6.

Definitions:

Dispositional Attributions

The tendency to attribute someone's behavior to their personality or character rather than to situational factors.

Situational Attributions

The process of explaining someone's behavior based on external factors, such as the situation or environment.

Hostile Behavior

Actions or attitudes that are aggressive, antagonistic, or unfriendly, often stemming from anger or resentment.

Dispositional Attribution

The tendency to attribute someone's behavior to their personality or character rather than to external factors.

Q20: On January 1,2013,Davie Services issued $20,000

Q31: A not-for-profit organization is not required to

Q36: DNA was incorporated on January 2,20X0 and

Q38: Which of the following statements about interim

Q66: Charter Services sells a service plan

Q114: A mortgage payable is a debt that

Q132: The current portion of notes payable must

Q192: Which answer reflects (in order)a good,a service,and

Q198: Effective marketing benefits society because it<br>A) reduces

Q210: do some executives feel that environmental factors